monterey county property tax due dates

Restaurants In Matthews Nc That Deliver. Town of Monterey MA.

Monterey County California Offers 22 New And Revamped Experiences For Travelers In 2022

A convenience fee is charged for paying with a CreditDebit card.

. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. February 15 Final deadline for filing of most exemption claims.

Monterey County Treasurer - Tax Collectors Office. District 4 - Wendy Root Askew. Additional evidence supporting your appeal will be needed.

District 1 - Luis Alejo. Receive a good insight into real estate taxes in Monterey County and what you should understand when your payment is due. Monterey County collects on average 051 of a propertys assessed fair market value as property tax.

Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid-October and payment may be made in two installments due as follows. For E-Check a flat fee of 025 is charged. 1st Installment - Due November 1st Delinquent after 500 pm.

Monterey County Tax Collector. Filing begins on various exemptions. Last day to file a claim for deferment of property taxes under the County Deferred Property Tax Program if property is located in a participating county.

Property taxes are due january 1st for the previous year. Zeeb Monterey County Treasurer-Tax Collector State of California Executed at Salinas County of Monterey California on October 8 2021. 16 rows First installment of secured property taxes is due and payable.

Monterey County Tax Collector. Monterey County Property Tax Due Dates. District 2 - John M.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. Property taxes are levied on property as it exists on January 1st at 1201 am. District 1 - Luis Alejo.

Are Dental Implants Tax Deductible In Ireland. For assistance in locating your ASMT number contact our office at 831 755-5057. Checks should be made payable to.

Or e-mail us at. Through Friday from 900 am. Monterey County Property Tax Due Dates.

April 1 Due date for filing Business Property Statements Apartment House Property Statements Mining and. July Tax bills are mailed and due upon receipt. Restaurants In Erie County Lawsuit.

April 10 Last day to pay Second Installment without penalties. As computed a composite tax rate times the market value total will provide the countys entire tax burden and include individual taxpayers share. Monterey County Tax Collector.

District 5 - Mary Adams. 2735a 275a 276a Rev. If the bill is mailed between Novermber 1st and June 30th.

For credit cards the fee is 225 of the total amount you are paying. Monterey County property taxes still due on Friday. Unsecured taxes must be paid on or before August 31st unless otherwise stated.

If you are contemplating moving there or just planning to invest in Monterey County real estate youll discover whether Monterey County. Yes you can pay your property taxes by using a DebitCredit card. Publish notice of dates when taxes due and delinquent.

January 1 Lien date the date property taxes become a lien on the property. First installments of 202122 annual secured property tax bills are due as of november 1st. District 3 - Chris Lopez.

BOE-571-F2 Registered And Show Horses Other Than Racehorse BOE-571-J Annual Racehorse Return BOE-571-J1 Report Of Boarded Horses. Secured property taxes are levied on property as it exists on January 1st at 1201 am. Property taxes are due january 1st for the previous year.

Clerk of the Board. For taxes entered to the unsecured roll as a result of a second change of ownership before the supplemental billing is made the taxes shall become delinquent on the last day of the month following the month in. All major cards MasterCard American Express Visa and Discover are accepted.

Second Installments of 202122 Annual Secured Property Tax Bills are due as of February 1st. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. PROPERTY TAX DUE DATE The deadline for payment of the first installment of 2021-2022 Monterey County Property Tax is.

Opry Mills Breakfast Restaurants. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property. On or before.

Majestic Life Church Service Times. State law says local tax collectors cannot extend the date. The installments due dates for fiscal 2021-2022 tax year are.

Second-half real estate taxes are scheduled to be due Friday July 15 2022. On or before November 1. The taxes are late if the first half is not paid by April 30th.

Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Thank You Mary A. Ultimate Monterey County Real Property Tax Guide for 2022.

First half of real estate taxes are scheduled to be due Friday February 18 2022 in the Treasurers Office. Taxcollectorcomontereycaus I certify or declare under penalty of perjury that the foregoing is true and correct. 630 PM PDT Apr 8 2020.

Between January 1 2022 and March. Monterey County has one of the highest median property taxes in the United States and is ranked 178th of the 3143 counties in order of median property taxes. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. The second installment of the 2019-20 property taxes are due on April 10 and Mary Zeeb Monterey Countys treasurer-tax collector is reminding property owners that theyre obligated to pay.

The California Transfer Tax Who Pays What In Monterey County

At A Glance Monterey County Monterey County Ca

Monterey County Fire Relief Fund Community Foundation For Monterey County

Monterey County Cannabusiness Law

A Message From Monterey County S Treasurer Tax Collector The Deadline For Second Installment Of Property Tax Is April 10th Monterey County Mdash Nextdoor Nextdoor

Contact Us United Way Monterey County

Calfresh Monterey County 2022 Guide California Food Stamps Help

Monterey County Regional Fire District

Monterey County Ca Property Data Real Estate Comps Statistics Reports

Monterey County California Fha Va And Usda Loan Information

North County Area Monterey County Ca

At A Glance Monterey County Monterey County Ca

Monterey County Approves Fines For Face Covering Order Violations News Information Monterey County Ca

Gis Mapping Data Monterey County Ca

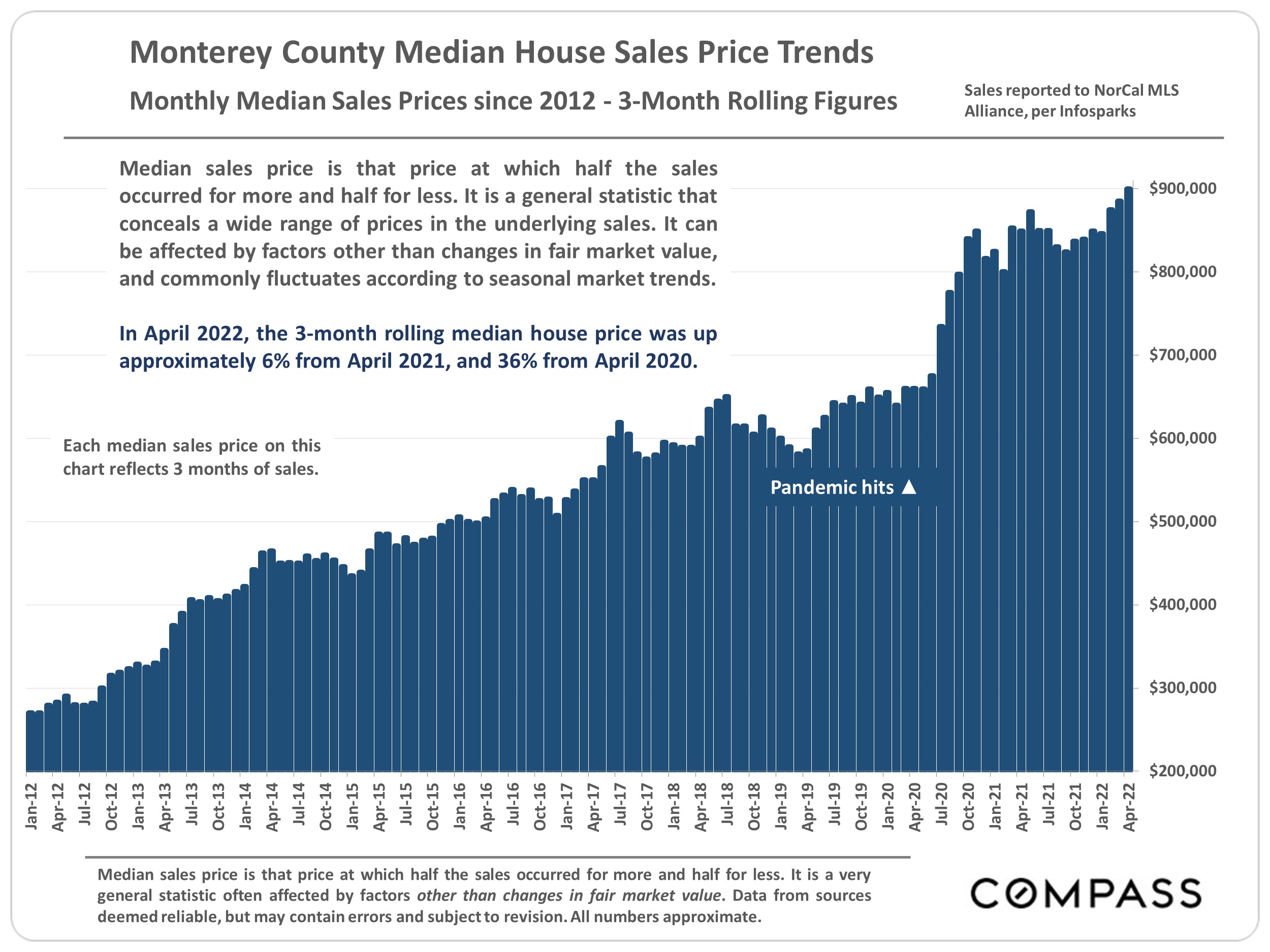

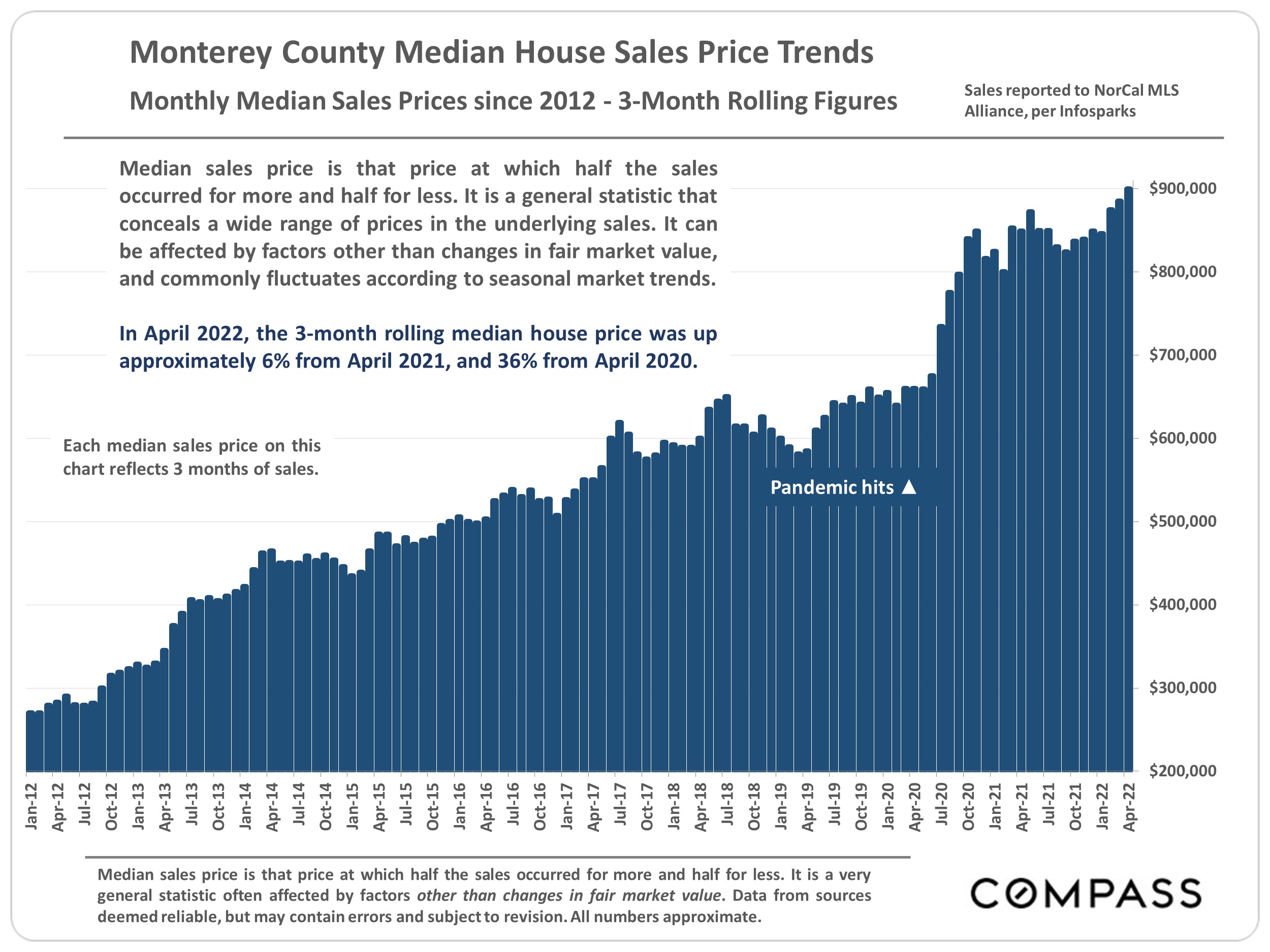

Monterey County Home Prices Market Trends Compass

Calfresh Monterey County 2022 Guide California Food Stamps Help

2022 Best Places To Buy A House In Monterey County Ca Niche

Contact Us United Way Monterey County

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More